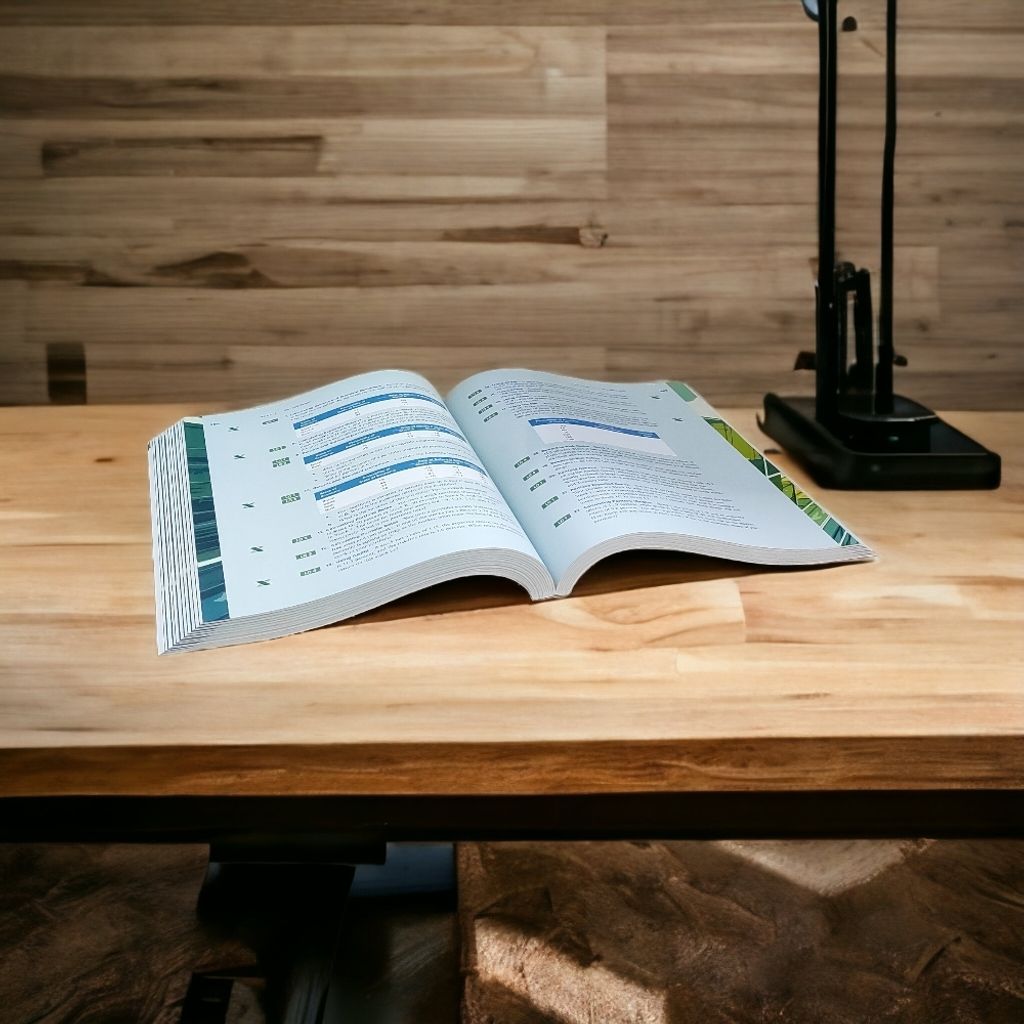

Essentials Of Corporate Finance, 9781265103514

- Regular price

- RM 35.00

- Sale price

- RM 35.00

- Regular price

-

RM 35.00

Share

9781265103514

Ross, Essentials of Corporate Finance, 10e, focuses on what undergraduate students with widely varying backgrounds and interests need to carry away from a core course in business or corporate finance. The goal is to convey the most important concepts and principles at a level that is approachable for the widest possible audience. To achieve this goal, subjects are distilled down to its bare essentials (hence, the name of this book), while retaining a decidedly modern approach to finance. Also, understanding the "why" is just as important, if not more so, than understanding the "how" - especially in an introductory course.

Readability and pedagogy are key. Essentials is written in a relaxed, conversational style that invites the students to join in the learning process rather than being a passive information absorber. Essentials downplays purely theoretical issues and minimizes the use of extensive and elaborate calculations to illustrate points that are either intuitively obvious or of limited practical use.

There are three basic themes visible throughout Essentials: emphasis on intuition/commonsense, a unified valuation approach, and a managerial focus.

Table of Contents

Part One: Overview of Financial Management

Ch. 1 Introduction to Financial Management?

Part Two: Understanding Financial Statements and Cash Flow?

Ch. 2 Financial Statements, Taxes, and Cash Flow?

Ch. 3 Working with Financial Statements?

Part Three: Valuation of Future Cash Flows

Ch. 4 Introduction to Valuation: The Time Value of Money?

Ch. 5 Discounted Cash Flow Valuation?

Part Four: Valuing Stocks and Bonds

Ch. 6 Interest Rates and Bond Valuation?

Ch. 7 Equity Markets and Stock Valuation?

Part Five: Capital Budgeting?

Ch. 8 Net Present Value and Other Investment Criteria?

Ch. 9 Making Capital Investment Decisions?

Part Six: Risk and Return?

Ch. 10 Some Lessons from Capital Market History?

Ch. 11 Risk and Return?

Part Seven: Long-Term Financing?

Ch. 12 Cost of Capital?

Ch. 13 Leverage and Capital Structure?

Ch. 14 Dividends and Dividend Policy?

Ch. 15 Raising Capital?

Part Eight: Short-Term Financial Management?

Ch. 16 Short-Term Financial Planning?

Ch. 17 Working Capital Management?

Part Nine: Topics in Business Finance?

Ch. 18 International Aspects of Financial Management?

Appendices?

Appendix A: Mathematical Tables??

Appendix B: Key Equations??

Appendix C: Answers to Selected End-of-Chapter Problems??

Appendix D: Using the HP-10B and TI BA II Plus Financial Calculators